Dear investor,

valued investor

Goal-oriented wealth planning and personal pension provision are increasingly becoming the focus of our savings and investment behavior.

This sets the course for success-oriented life planning. Our guideline for the Swiss depot is:

Assets. Administer. multiply.

With the Swiss custody account, we offer you the opportunity to set your long-term investment goals today. Already received with small starting amounts

you have access to a Swiss bank.

In this way, you can flexibly achieve your personal wealth target with regular contributions or one-off investments.

Discuss your personal financial situation and your investment goals with your advisor and define your personal wealth goal. You too can look forward to a secure future with your goal-oriented wealth planning. The Swiss depot financial concept: as individual as you are - as flexible as your life.

Stable financial center

The Swiss financial and banking center occupies a leading position worldwide. He has a proven tradition and great know-how.

With the fund-based Depot you benefit from the proven Swiss banking culture, its quality and competence. The economic and political stability of Switzerland ensures further security.

Swiss quality principles Precision, diligence and analysis - typically Swiss qualities - determine the financial concept.

You can rely on these values.

Secure your assets now !!

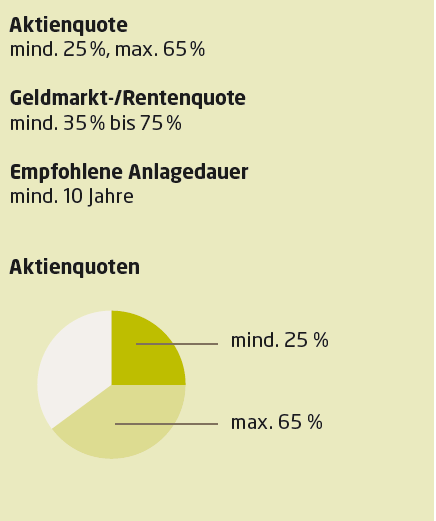

In three simple investment ways you canHERinvest wealth,

that suit your personal financial situation and your investment goals in retirement.

Savings rates already off €100 monthly and as a one-time investment €2,500 possible

For safety-oriented and conservative investors

Investment opportunity for customers who are balanced-u. are growth oriented

Top returns for investors who follow the trends of the time.

When you think of banks, you think of them Switzerland. The Swiss banking system is one of the most important in the world. Its good reputation is based on political and economic stability and sustainable investment.

Swiss banks are popular with wealthy individuals for the following reasons: Swiss banks specialize in wealth. Some Swiss banks can provide access to investment opportunities that would otherwise be inaccessible. Swiss banks have a high credit rating. This sets the course for success-oriented life planning.

Our guideline for your wealth in Switzerland is:

Assets. Administer. multiply.

With the Swiss custody account, we offer you the opportunity to set your long-term investment goals today. Even with small starting amounts you get access to a Swiss investment opportunity. In this way, you can flexibly achieve your personal wealth target with regular contributions or one-off investments.

Discuss your personal financial situation and your investment goals with your advisor and define your personal wealth goal. You too can look forward to a secure future with your goal-oriented wealth planning. The Swiss depot financial concept: as individual as you are - as flexible as your life.

Stable financial center

The Swiss financial and banking center occupies a leading position worldwide. He has a proven tradition and great know-how. With the fund-based "Swiss Depot" you benefit from the proven Swiss banking culture, its quality and competence. The economic and political stability of Switzerland ensures further security. Swiss quality principles Precision, diligence and analysis - typically Swiss qualities - determine the Swiss custody account financial concept. You can rely on these values.

- Capital market access to the European single market and Switzerland

- High political, economic and social stability

- Moderate corporate taxation

- AAA country rating by Standard & Poor's

- high investor security

- not affected by Schufa

- very strong banking secrecy

- attractive tax conditions

- good, German-speaking service

- no information to German institutions

- high deposit security

- low national debt

- very low inflation rate

- Discreet and confidential wealth management in Switzerland

It's about HER Money

Back up HER Assets

The inflation rate in Switzerland is at 2.9 percent in May dropped, as the Swiss Federal Statistical Office (FSO) announced today (05/02/2023). In February, the inflation rate was still 3.4 percent. It rose significantly in the first two months of the year, among other things due to higher electricity and flight prices; now the inflation rate is back to what it was in December.

Is another financial crisis looming?

Will our economy collapse?

- The fight against climate change in Germany will soon also affect apartments and houses with full legal force - and thus above all owners. The nervousness increases. And the sound gets louder.

- The European Union aims to be climate neutral by 2050. A refurbishment obligation for old buildings, which the EU Parliament has now approved, should contribute to this.

- Energy, staff shortages, corona - hospitals on the verge of collapse

- Hospital collapse "can hardly be stopped": Gloomy forecast for 2023

- The German hospital company fears a wave of insolvencies in the coming year.

- Insolvencies in nursing homes: "The system is on the verge of collapse". Nursing facility calls for clear announcements for Corona autumn

- At the same time, energy prices are rising, fueling inflation. There is therefore a risk of an economic downturn combined with a high inflation rate of more than five percent.

- Investing in times of inflation: How to invest money when interest rates are low?

- SAG: The legal expropriation by law (Reorganization and Liquidation Act)

(among other things also read §314 VAG and §1 LAG - goal of load balancing) - More and more people want to spend their old age abroad

What do you think about it?

information about

Mr. Werner Roth

Jahnstr. 19

D-67360 Lingenfeld

- Appointments by prior arrangement only -

Telephone: 49 (0) 172 / 87 87 833

Email: roth@riv-immobilienshop.de